Investment Opportunity

Join the growth engine of Asia Pacific data center market

Project Overview

The Sacheon HyperCloud Data Campus is a 300MW AI-ready hyperscale campus in southern Korea, developed by PDI Design Group (U.S.) and PDI Korea Lab. The project is supported by a U.S.-based lead investor, major Korean commercial banks, and designated as a national Opportunity Zone.

Built on 150,650㎡, HCDC provides scalable power (345kV dual-grid), hybrid liquid-air cooling (PUE 1.25), and Tier-1 construction execution for reliability.

Expansion & Government Support

Phase 2 and 3 lands (95,000㎡) available for joint development.

Up to KRW 600B tax relief under Opportunity Zone designation.

Investment Highlights

Strategic advantages for long-term growth

Scalable Growth

Expandable from 100MW to 300MW capacity

Strategic Location

Asia-Pacific connectivity hub

Infrastructure Stability

Tier III-V certified facilities

Market Opportunity

The Asia-Pacific data center market is experiencing unprecedented growth driven by digital transformation and cloud adoption.

Korea's strategic position as a regional hub offers unique advantages for hyperscale operations.

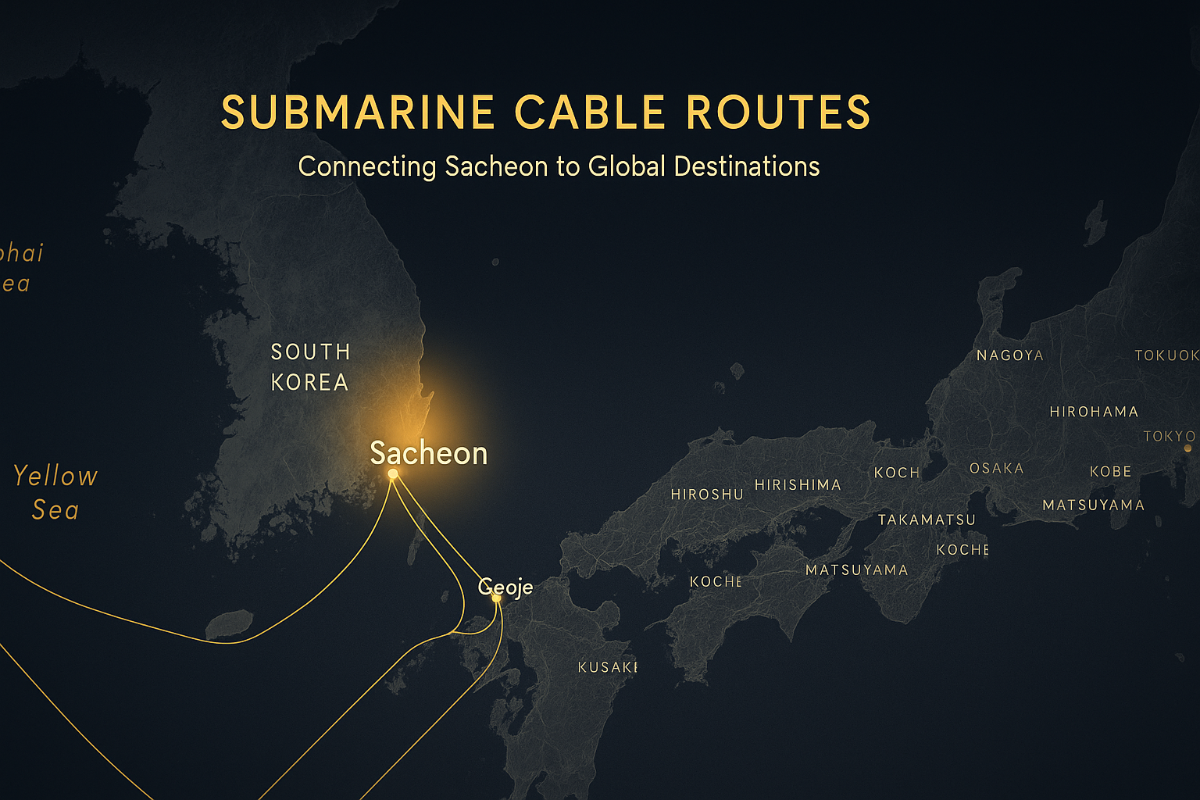

Subsea cable connectivity to major Asian markets provides low-latency access to key financial and technology centers.

Strategic Position in Asia-Pacific Submarine Cable Network

Investment Benefits

Strong Returns

Attractive yield potential with stable cash flows

Government Incentives

Tax benefits and infrastructure support

Strategic Partnership

Collaboration with leading technology providers

Future-Ready

Designed for next-generation workloads

Financial Projections

Phased development approach for sustainable growth

Phase 1

2025-2027

- • 100MW capacity

- • $500M investment

- • Revenue generation start

- • Market establishment

Phase 2

2027-2028

- • Additional 100MW

- • Capacity expansion

- • Customer base growth

- • Enhanced services

Phase 3

2028-2029

- • Final 100MW build-out

- • Full campus operation

- • Market leadership

- • Maximum returns

Project Finance Structure (Public Summary)

Equity Structure

Strategic investor group (lead: U.S.-based investor).

Debt Financing

Senior debt: local finance institutions; layered tranches for Phase 1/2.

Developer/Advisor

PDI (design, PM, advisory).

Capital & Deployment

Design/licensing mobilization

Initial capital deployment for design and permitting

Phase 1 drawdowns begin

Construction financing and infrastructure development

COD (target) & ramp-up

Commercial operation and revenue generation

Government Programs

Opportunity Zone

Tax relief & infra support

Permitting

Fast-track permitting with local authority

Local Impact

Economic Development

Job creation (construction/operation), regional tech cluster uplift.

Investment Attraction

Foreign direct investment attraction and export capability expansion.

Ready to Invest?

Join us in building Korea's premier data center campus